The Fintech Radar: what will be the key to bank-fintech partnership success?

The last three months have seen a raft of new partnerships between fintechs and banks announced.

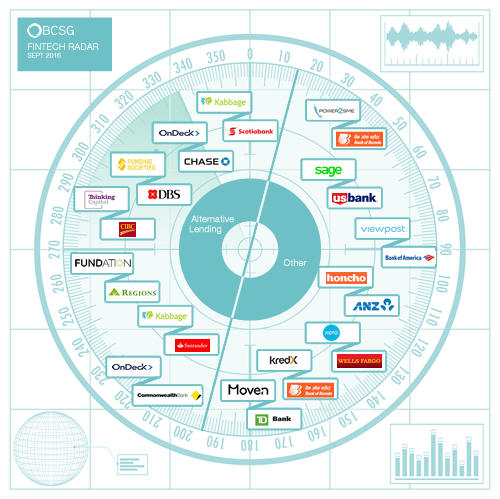

BCSG’s latest Fintech radar (right) illustrates that while around half of these new relationships are between banks and alternative lending providers, a growing number are with tech firms offering other various services for small business customers.

These include ANZ’s partnership with Honcho, the app that enables SMEs to register, set up and start running their business online in minutes; the data-sharing platform created between Wells Fargo and accounting software firm Xero; and Bank of America offering a new online invoicing and payment system, provided by Viewpost.

Coverage by the media in this space has seen a more positive shift accordingly. Whereas previously speculation has focused upon the potentially damaging effects of new entrants upon banks, now headlines about the benefits of a closer working relationship between banks and fintechs abound.

Lasting partners or ships in the night?

How many of these new announcements will stand the test of time and become truly value-creating for all involved, and how many are simply window dressing that will fade into obscurity with little benefit realised, remains to be seen.

Success or failure will largely depend upon the nature of the relationship – is it a partnership in the true sense of the word?

True partnerships entail sharing a vision, values, goals and risk. Moreover, they inherently demand an investment in cost, time and the effort of making the partnership work effectively to the benefit of both parties.

The problem in championing such bank-fintech partnerships is that many fintechs offer little more than added features to complement existing core banking products (such as Debitize, Digit, Qapital, and Acorns – all of which must link into existing current or savings accounts).

Sure, these can help add new services and increase value for customers, but turning relationships with these providers into a true partnership as defined above is going to cost a lot of time and money.

And because the new service is likely to only apply to a small percentage of the customer base, profit potential from any one partnership maybe small.

So what’s the best strategy for banks to work with fintechs in a way that benefits the bank, the fintech and the customer?

Building a framework that works

Banks need to develop the capability – the framework and the technology – to handle these partnerships effectively.

This will allow banks to team up with fintechs and offer their solutions, but reduce the cost and time-investment of a true, traditional partnership model.

Investing in platforms gives banks the ability to scale and adapt rapidly. To truly capitalize on the fintech explosion and offer more, banks need to develop platforms that easily allow a large number of fintechs to plug in and out a model already built to maximise the chances of success

Moving towards such a plug-and-play business model allows multiple participants (producers and consumers) to connect, interact with each other – and create an exchange value.

Where individual partnerships require a lot of effort and can only be done with a limited number of companies, platforms enable a much greater level of scale.

Navigating the path ahead

Of course implementing such an approach does not come without its challenges.

It’s important that banks have controls in place around the platform, to ensure satisfactory compliance standards are met. The key to the approach however is that the model is standardised, allowing deeper integration to be achieved more easily and efficiently – which in turn gives a better chance of success.

So what for the recently announced glut of bank-fintech partnerships?

Which will have the requisite level of effort put into making them successful, and which will be written off as ‘learning for the future’?

Only time will tell.

For more insights on small business fintech and to explore how you can enhance your digital banking proposition for SMEs, take a look at our first fintech radar to see what other business applications are on the market here.